A company with a high debt-to-equity ratio uses more debt to fund its operations than a company with a lower debt-to-equity ratio. Common debt ratios include debt-to-equity, debt-to-assets, long-term debt-to-assets, and leverage and gearing ratios. In the consumer lending and mortgage business, two common debt ratios used to assess a borrower’s ability to repay a loan or mortgage are the gross debt service ratio and the total debt service ratio.

Formula and Calculation of the D/E Ratio

In this guide, we’ll explain everything you need to know about the D/E ratio to help you make better financial decisions. Our writing and editorial staff are a team of experts holding advanced financial designations and have written for most major financial media publications. Our work has been directly cited by organizations including Entrepreneur, Business Insider, Investopedia, Forbes, CNBC, and many others. We follow strict ethical journalism practices, which includes presenting unbiased information and citing reliable, attributed resources. The articles and research support materials available on this site are educational and are not intended to be investment or tax advice. All such information is provided solely for convenience purposes only and all users thereof should be guided accordingly.

How to Calculate the D/E Ratio in Excel

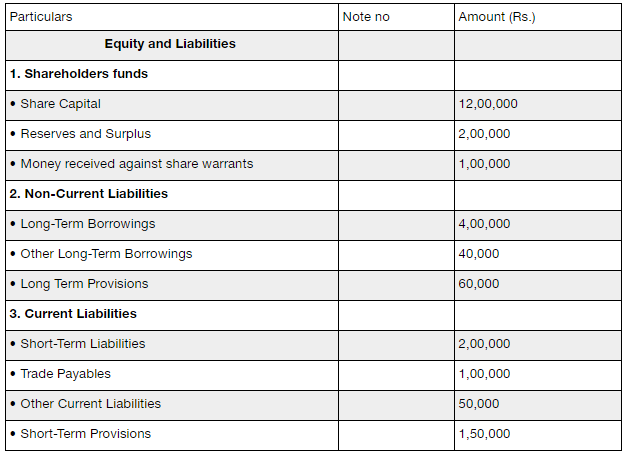

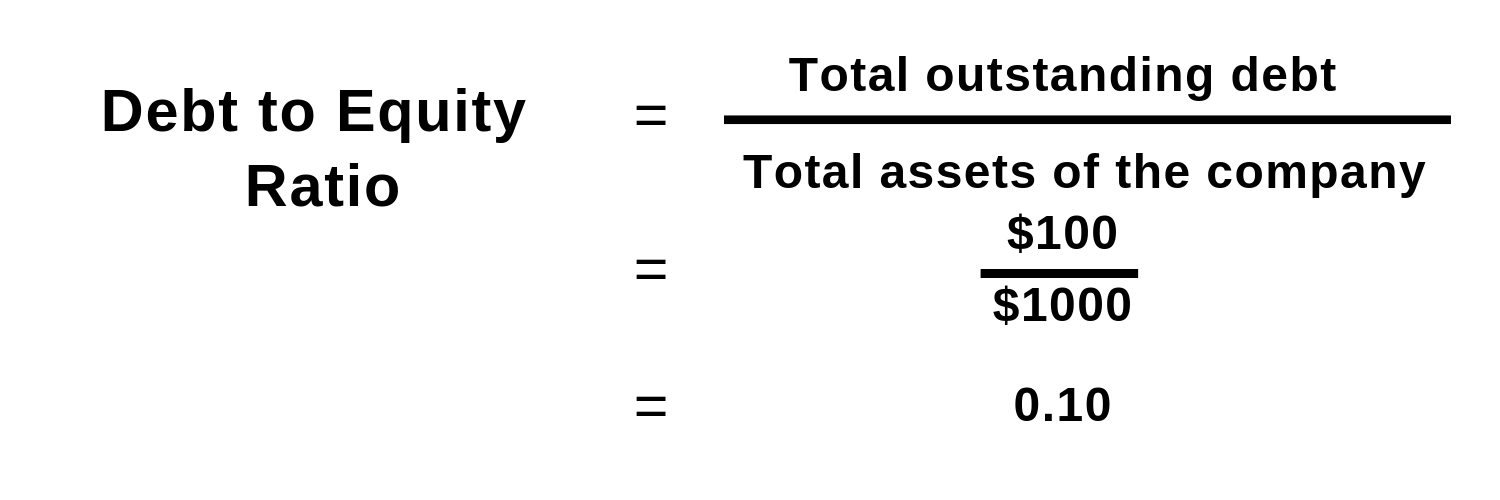

Overall, D/E ratios will differ depending on the industry because some industries tend to use more debt financing than others. The debt-to-equity ratio is calculated by dividing total liabilities by shareholders’ equity or capital. The Debt to Equity ratio is a financial metric that compares a company’s total debt to its loan note payable borrow accrued interest and repay shareholder equity. Each industry has different debt to equity ratio benchmarks, as some industries tend to use more debt financing than others. A debt ratio of .5 means that there are half as many liabilities than there is equity. In other words, the assets of the company are funded 2-to-1 by investors to creditors.

- Generally speaking, a debt-to-equity or debt-to-assets ratio below 1.0 would be seen as relatively safe, whereas ratios of 2.0 or higher would be considered risky.

- The quick ratio measures the capacity of a company to pay its current liabilities without the need to sell its inventory or acquire additional financing.

- But utility companies have steady inflows of cash, and for that reason having a higher D/E may not spell higher risk.

- Debt-financed growth may serve to increase earnings, and if the incremental profit increase exceeds the related rise in debt service costs, then shareholders should expect to benefit.

- Taking a broader view of a company and understanding the industry its in and how it operates can help to correctly interpret its D/E ratio.

Significance in Financial Analysis

For instance, a company with $200,000 in cash and marketable securities, and $50,000 in liabilities, has a cash ratio of 4.00. This means that the company can use this cash to pay off its debts or use it for other purposes. The cash ratio provides an estimate of the ability of a company to pay off its short-term debt.

Get in Touch With a Financial Advisor

Conversely, a low D/E ratio suggests that a company has ample shareholders’ equity, reducing the need to rely on debt for its operational needs. This indicates that the company is primarily financed through its own resources, reflecting strong financial stability and a lower risk profile. While the D/E ratio is primarily used for businesses, the concept can also be applied to personal finance to assess your own financial leverage, especially when considering loans like a mortgage or car loan. It is crucial to consider the industry norms and the company’s financial strategy when assessing whether or not a D/E ratio is good. Additionally, the ratio should be analyzed with other financial metrics and qualitative factors to get a comprehensive view of the company’s financial health. This number represents the residual interest in the company’s assets after deducting liabilities.

In general, if a company’s D/E ratio is too high, that signals that the company is at risk of financial distress (i.e. at risk of being unable to meet required debt obligations). If a company cannot pay the interest and principal on its debts, whether as loans to a bank or in the form of bonds, it can lead to a credit event. The D/E ratio is one way to look for red flags that a company is in trouble in this respect. When looking at a company’s balance sheet, it is important to consider the average D/E ratios for the given industry, as well as those of the company’s closest competitors, and that of the broader market. A company that does not make use of the leveraging potential of debt financing may be doing a disservice to the ownership and its shareholders by limiting the ability of the company to maximize profits.

You could also replace the book equity found on the balance sheet with the market value of the company’s equity, called enterprise value, in the denominator, he says. “The book value is beholden to many accounting principles that might not reflect the company’s actual value.” Let’s look at a few examples from different industries to contextualize the debt ratio.

On the surface, the risk from leverage is identical, but in reality, the second company is riskier. To get a clearer picture and facilitate comparisons, analysts and investors will often modify the D/E ratio. They also assess the D/E ratio in the context of short-term leverage ratios, profitability, and growth expectations. Other industries that tend to have large capital project investments also tend to be characterized by higher D/E ratios.

This is also true for an individual applying for a small business loan or a line of credit. The personal D/E ratio is often used when an individual or a small business is applying for a loan. Lenders use the D/E figure to assess a loan applicant’s ability to continue making loan payments in the event of a temporary loss of income. Finally, if we assume that the company will not default over the next year, then debt due sooner shouldn’t be a concern. In contrast, a company’s ability to service long-term debt will depend on its long-term business prospects, which are less certain. If both companies have $1.5 million in shareholder equity, then they both have a D/E ratio of 1.

While acceptable D/E ratios vary by industry, investors can still use this ratio to identify companies in which they want to invest. First, however, it’s essential to understand the scope of the industry to fully grasp how the debt-to-equity ratio plays a role in assessing the company’s risk. Using excel or another spreadsheet to calculate the D/E is relatively straightforward. First, using the company balance sheet, pull the total debt amount and the total shareholder equity amount, and enter these numbers into adjacent cells (e.g. E2 and E3). The term “leverage” reflects the hope that the company will be able to use a relatively small amount of debt to boost its growth and earnings.