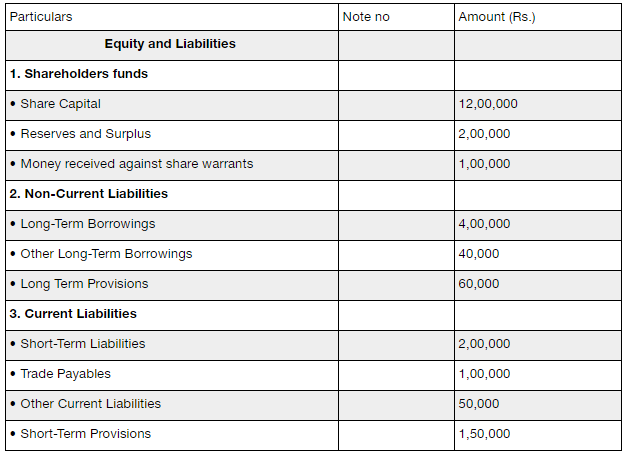

On the other hand, the typically steady preferred dividend, par value, and liquidation rights make preferred shares look more like debt. We can see below that for Q1 2024, ending Dec. 30, 2023, Apple had total liabilities of $279 billion and total shareholders’ equity of $74 billion. Business owners use a variety of software to track D/E ratios and other financial metrics.

What is considered a good debt-to-equity ratio?

As a result, drawing conclusions purely based on historical debt ratios without taking into account future predictions may mislead analysts. A ratio greater than 1 shows that a considerable amount of a company’s assets are funded by debt, which means the company has more liabilities than assets. A high ratio indicates that a company may be at risk of default on its loans if interest rates suddenly rise.

Ask a Financial Professional Any Question

- Both ratios, however, encompass all of a business’s assets, including tangible assets such as equipment and inventory and intangible assets such as copyrights and owned brands.

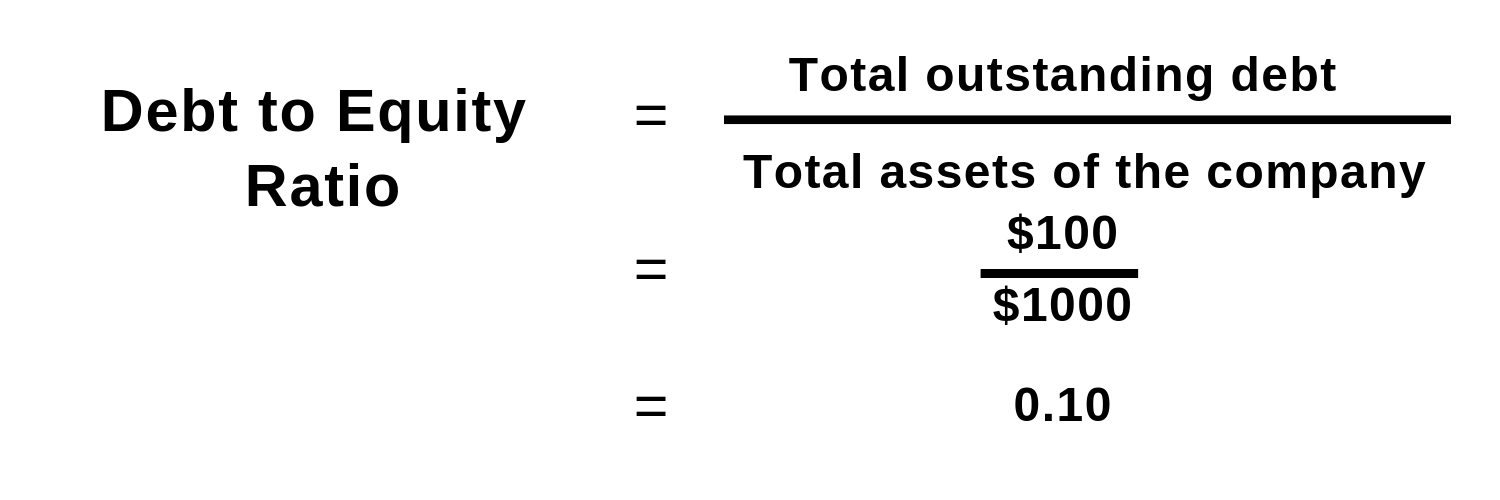

- In summary, computing the Debt to Equity ratio is essential for assessing financial health and risk.

- A higher D/E ratio means that the company has been aggressive in its growth and is using more debt financing than equity financing.

- Generally speaking, a D/E ratio below 1 would be seen as relatively safe, whereas values of 2 or higher might be considered risky.

- Of note, there is no “ideal” D/E ratio, though investors generally like it to be below about 2.

Also, this ratio looks specifically at how much of a company’s assets are financed with debt. The debt-to-equity (D/E) ratio is used to evaluate a company’s financial leverage and is calculated by dividing a company’s total liabilities by its shareholder equity. It is a measure of the degree to which a company is financing its operations with debt rather than its own resources. Debt typically has a lower cost of capital compared to equity, mainly because of its seniority in the case of liquidation. Thus, many companies may prefer to use debt over equity for capital financing.

Debt to Equity Ratio Calculator (D/E)

First, higher interest rates can lead to increased interest expenses for companies with significant debt, potentially elevating the D/E ratio. Conversely, lower interest rates can reduce interest expenses, resulting in a lower D/E ratio. “Today, we are witnessing energy companies with strong balance sheets. Management teams have learned the lessons of prior years and have retired a lot of outstanding debt.” While using total debt in the numerator of the debt-to-equity ratio is common, a more revealing method would use net debt, or total debt minus cash in cash and cash equivalents the company holds. Here’s what you need to know about the debt-to-equity ratio and what it reveals about a company’s capital structure to make better investing decisions.

Can a Debt Ratio Be Negative?

In some cases, the debt-to-equity calculation may be limited to include only short-term and long-term debt. Together, the total debt and total equity of a company combine to equal its total capital, which is also accounted for as total assets. The debt/equity ratio serves as a critical tool for financial analysis, offering valuable insights into a company’s business succession planning financial leverage and risk profile. Investors, creditors, and analysts leverage this ratio to assess a company’s creditworthiness, financial stability, and investment potential. Additionally, benchmarking these ratios against industry peers provides a more comprehensive assessment of the companies’ capital structures and financial health.

How Can the Debt-to-Equity Ratio Be Used to Measure a Company’s Risk?

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. This is helpful in analyzing a single company over a period of time and can be used when comparing similar companies. It is important to note that the D/E ratio is one of the ratios that should not be looked at in isolation but with other ratios and performance indicators to give a holistic view of the company.

When used to calculate a company’s financial leverage, the debt usually includes only the Long Term Debt (LTD). The composition of equity and debt and its influence on the value of the firm is much debated and also described in the Modigliani–Miller theorem. An increase in the D/E ratio can be a sign that a company is taking on too much debt and may not be able to generate enough cash flow to cover its obligations.

One limitation of the D/E ratio is that the number does not provide a definitive assessment of a company. In other words, the ratio alone is not enough to assess the entire risk profile. These can include industry averages, the S&P 500 average, or the D/E ratio of a competitor.

This figure means that for every dollar in equity, Restoration Hardware has $3.73 in debt. As noted above, the numbers you’ll need are located on a company’s balance sheet. In addition, the reluctance to raise debt can cause the company to miss out on growth opportunities to fund expansion plans, as well as not benefit from the “tax shield” from interest expense.