Therefore, even if such companies have high debt-to-equity ratios, it doesn’t necessarily mean they are risky. For example, companies in the utility industry must borrow large sums of cash to purchase costly assets to maintain business operations. However, since they have high cash flows, paying off debt happens quickly and does not pose a huge risk to the company.

Would you prefer to work with a financial professional remotely or in-person?

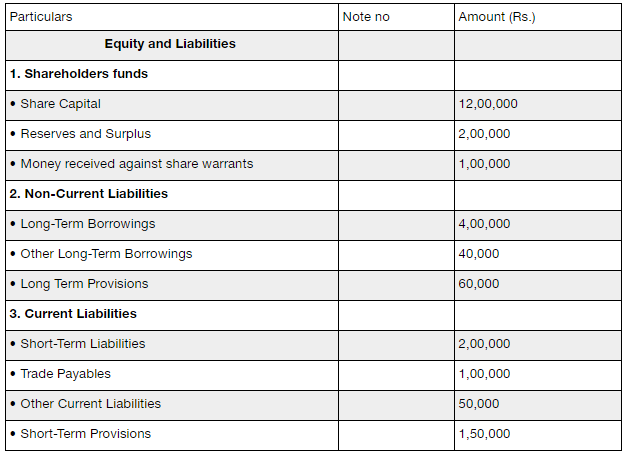

A ratio below 1 means that a greater portion of a company’s assets is funded by equity. For instance, utility companies often exhibit high D/E ratios due to their capital-intensive nature and steady income streams. These companies frequently borrow extensively, given their stable returns, making high leverage ratios a common and efficient use of capital in this slow-growth sector. Similarly, companies in the consumer staples industry tend to show higher D/E ratios for comparable reasons. A D/E ratio of 1.5 would indicate that the company has 1.5 times more debt than equity, signaling a moderate level of financial leverage.

Debt Ratio vs. Long-Term Debt to Asset Ratio

This is because when a company takes out a loan, it only has to pay back the principal plus interest. If the company were to use equity financing, it would need to what are the different types of ledger books with pictures sell 100 shares of stock at $10 each. It is the opposite of equity financing, which is another way to raise money and involves issuing stock in a public offering.

- Companies with a higher debt to equity ratio are considered more risky to creditors and investors than companies with a lower ratio.

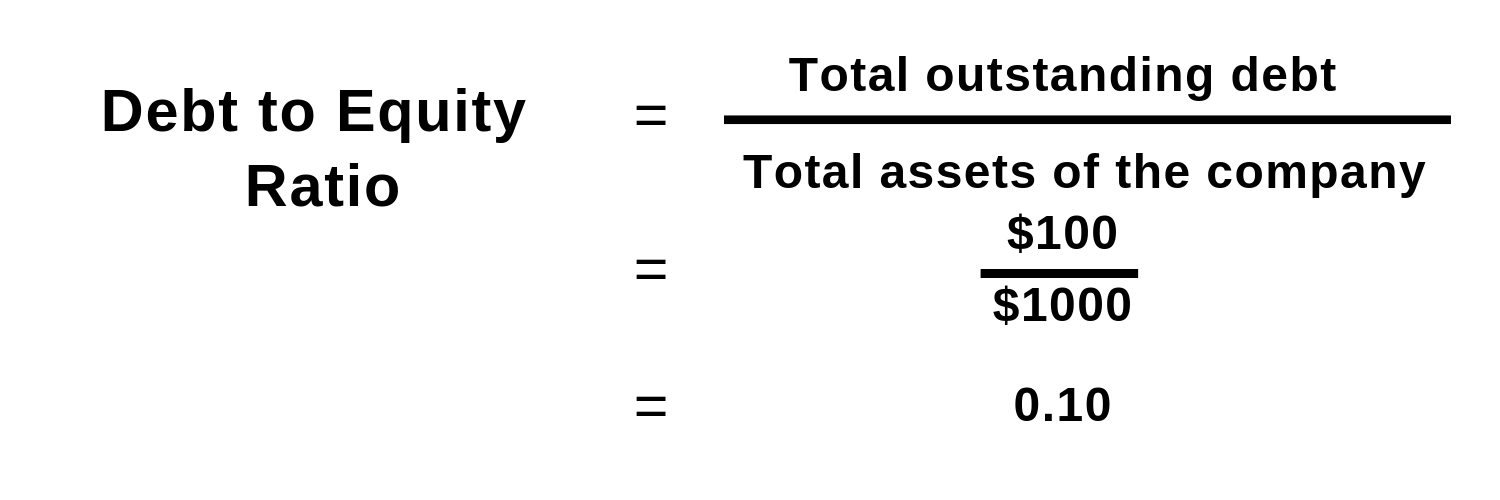

- You can calculate the debt-to-equity ratio by dividing shareholders’ equity by total debt.

- The articles and research support materials available on this site are educational and are not intended to be investment or tax advice.

- This advantage can make the use of debt more attractive, even if the D/E ratio is higher than comparable companies.

Which of these is most important for your financial advisor to have?

The higher the debt ratio, the more leveraged a company is, implying greater financial risk. At the same time, leverage is an important tool that companies use to grow, and many businesses find sustainable uses for debt. Some sources consider the debt ratio to be total liabilities divided by total assets. This reflects a certain ambiguity between the terms debt and liabilities that depends on the circumstance. The debt-to-equity ratio, for example, is closely related to and more common than the debt ratio, instead, using total liabilities as the numerator. When evaluating a company’s debt-to-equity (D/E) ratio, it’s crucial to take into account the industry in which the company operates.

Do you already work with a financial advisor?

The D/E ratio also gives analysts and investors an idea of how much risk a company is taking on by using debt to finance its operations and growth. The debt-to-equity ratio (D/E) is calculated by dividing the total debt balance by the total equity balance. By contrast, higher D/E ratios imply the company’s operations depend more on debt capital – which means creditors have greater claims on the assets of the company in a liquidation scenario. Lenders and debt investors prefer lower D/E ratios as that implies there is less reliance on debt financing to fund operations – i.e. working capital requirements such as the purchase of inventory. A D/E ratio of about 1.0 to 2.0 is considered good, depending on other factors like the industry the company is in. But a D/E ratio above 2.0 — i.e., more than $2 of debt for every dollar of equity — could be a red flag.

If investors want to evaluate a company’s short-term leverage and its ability to meet debt obligations that must be paid over a year or less, they can use other ratios. These balance sheet categories may include items that would not normally be considered debt or equity in the traditional sense of a loan or an asset. Because the ratio can be distorted by retained earnings or losses, intangible assets, and pension plan adjustments, further research is usually needed to understand to what extent a company relies on debt.

A company’s accounting policies can change the calculation of its debt-to-equity. For example, preferred stock is sometimes included as equity, but it has certain properties that can also make it seem a lot like debt. Specifically, preferred stock with dividend payment included as part of the stock agreement can cause the stock to take on some characteristics of debt, since the company has to pay dividends in the future.

So, the debt-to-equity ratio of 2.0x indicates that our hypothetical company is financed with $2.00 of debt for each $1.00 of equity. Andy Smith is a Certified Financial Planner (CFP®), licensed realtor and educator with over 35 years of diverse financial management experience. He is an expert on personal finance, corporate finance and real estate and has assisted thousands of clients in meeting their financial goals over his career.

Used in conjunction with other measures of financial health, the debt ratio can help investors determine a company’s risk level. So if a company has total assets of $100 million and total debt of $30 million, its debt ratio is 0.3 or 30%. Is this company in a better financial situation than one with a debt ratio of 40%?